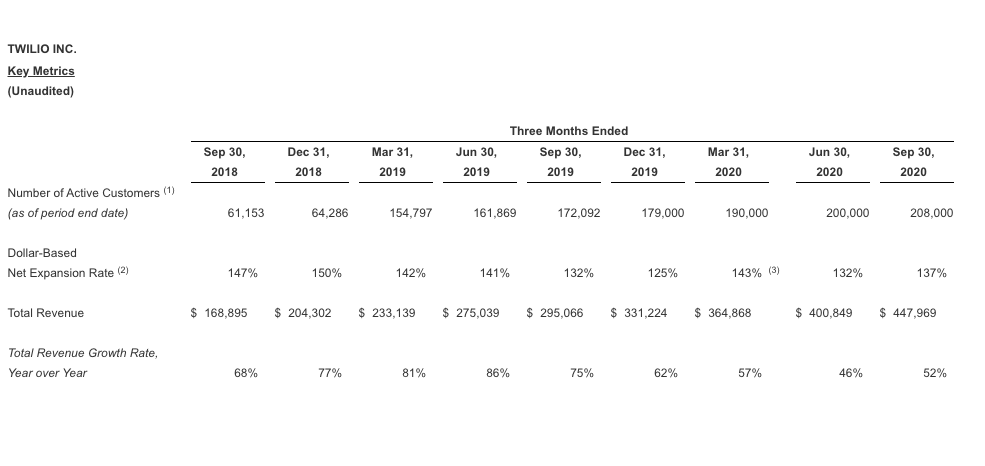

Twilio reported better-than-expected third quarter financial results Monday driven by continued customer momentum. The cloud communications as a service provider reported a net loss of 79 cents a share on revenue of $448.8 million, up 52% year over year. Non-GAAP earnings were 4 cents a share.

Wall Street was expecting a loss of 3 cents a share on revenue of $409.79 million. Twilio's share price was down just over 2% in after hours trading.

Twilio offers a bevy of communications services and its roadmap makes the company more of a customer engagement platform. Twilio in the quarter acquired Segment, a player in the customer data platform (CDP) market, in an all-stock deal worth $3.2 billion. Twilio says it now has 208,000 active customer accounts, up from 172,000 in Q3 2019.

For the current quarter, analysts are expecting Twilio to report a net income of a penny per share on revenue of $436.8 million. Twilio responded with revenue expectations between $450 million to $455 million with an adjusted earnings loss of 11 cents to 8 cents.

"Great digital engagement is becoming more critical to differentiate the customer experience, and companies across industries and around the world are choosing Twilio's customer engagement platform to build these solutions," said Twilio CEO Jeff Lawson. "Our performance in the third quarter is further evidence that Twilio's platform provides three things that every company needs today — digital communications, software agility, and cloud scale."

RELATED:

- How Twilio's $3.2 billion Segment acquisition transforms the company

- Twilio unveils new Microvisor IoT platform, Event Streams API

- Twilio shares rise as the company says Q3 outlook brighter than expected

- Twilio partners with more cities, universities to power contact tracing systems

- Twilio tapped to provide communications layer for NYC's contact tracing program

User Center

User Center My Training Class

My Training Class Feedback

Feedback

Comments

Something to say?

Log in or Sign up for free