Okta on Wednesday announced its plans to acquire Auth0, an identity platform for developers, in a stock transaction valued at around $6.5 billion. The boards of directors of both companies have approved the deal, which is expected to close during the quarter ending July 31.

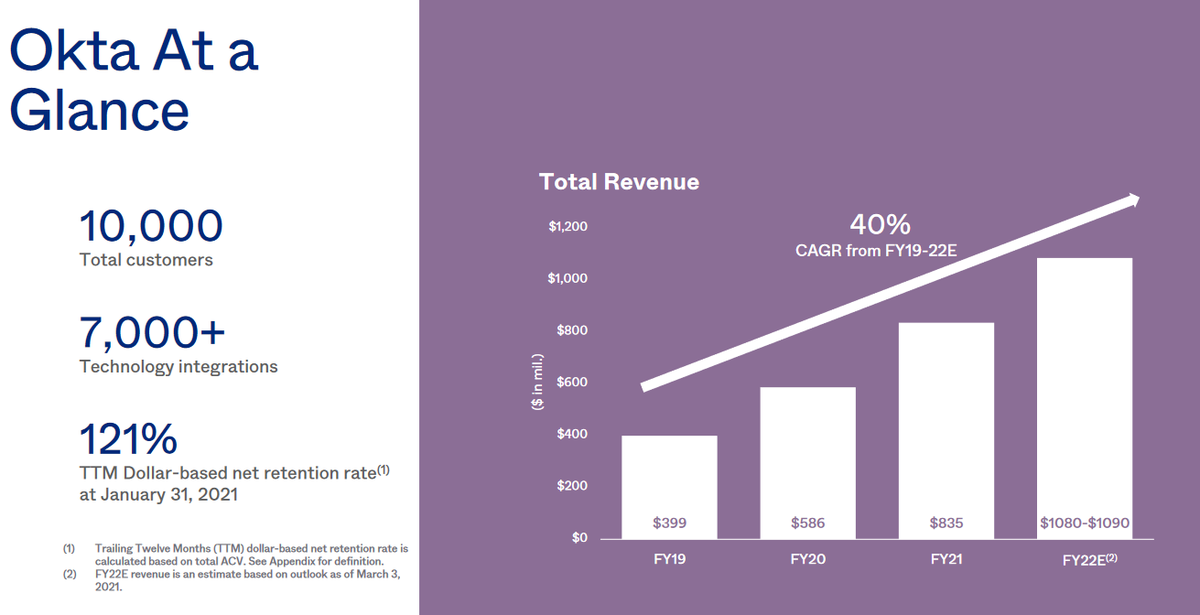

Founded in 2013, AuthO has more than 9,000 enterprise customers, and it has a presence in more than 70 countries. Okta provides identity management tools -- used to identify employees and customers -- for more than 10,000 organizations.

Once the deal is complete, Auth0 will operate as an independent business unit inside of Okta. Both platforms will be supported and invested in, Okta said, and integrated over time.

"Combining Auth0's developer-centric identity solution with the Okta Identity Cloud will drive tremendous value for both current and future customers," Okta CEO Todd McKinnon said in a statement. "In an increasingly digital world, identity is the unifying means by which we use technology — both at work and in our personal lives."

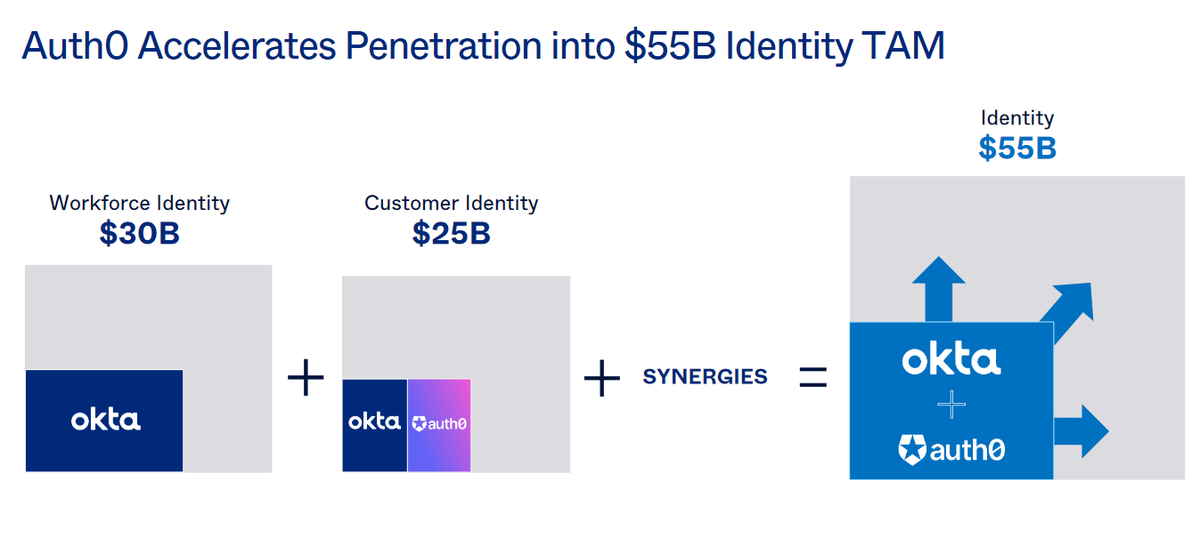

Okta argues that trends in IT, including the adoption of cloud and hybrid IT, digital transformation initiatives and the embrace of zero-trust security, make identity management an increasingly important element of digital security. The overall identity market is valued at $55 billion, Okta said.

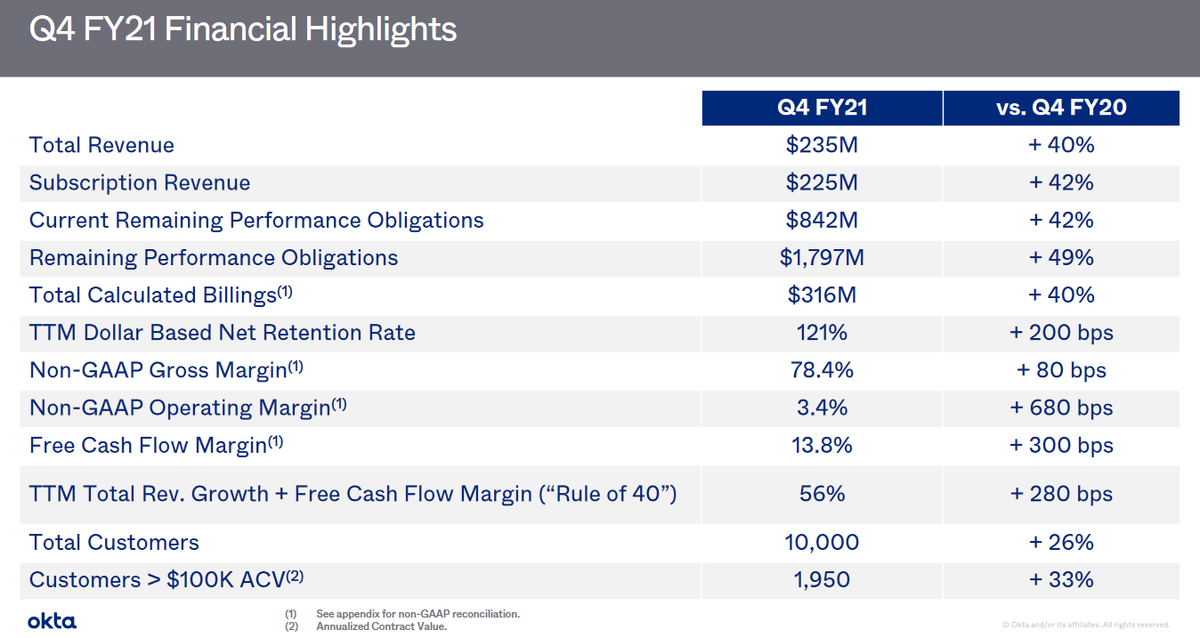

Okta on Wednesday also announced its fourth quarter financial results, beating market expectations, and gave an outlook for more than $1 billion in FY 2022 sales.

Q4 non-GAAP net income was $8 million, or 6 cents per share. Revenue was $234.7 million, an increase of 40 percent year-over-year.

Analysts were expecting a net loss of 1 cent per share on revenue of $221.85 million.

For the full FY 2021, Okta's non-GAAP basic and diluted net income per share were 13 cents and 11 cents, respectively. Total revenue was $835.4 million, an increase of 43 percent year-over-year.

Fourth quarter subscription revenue was $225.4 million, an increase of 42 percent year-over-year. FY 2021 subscription revenue was $796.6 million, an increase of 44 percent year-over-year.

Q4 total calculated billings were $316 million, an increase of 40 percent year-over-year. Total calculated billings for the full year were $976 million, an increase of 39 percent year-over-year.

For the first quarter of fiscal 2022, the company expects a non-GAAP net loss per share of 21 cents to 20 cents. Revenue is expected to be between $237 million and $239 million.

For the full year fiscal 2022, Okta expects a non-GAAP net loss per share of 49 cents to 44 cents. It expects revenue of $1.08 billion to $1.09 billion, representing a growth rate of 29 percent to 30 percent year-over-year.

User Center

User Center My Training Class

My Training Class Feedback

Feedback

Comments

Something to say?

Log in or Sign up for free