Cloud observability and AIOps provider Dynatrace reported better-than-expected fourth quarter results and raised its revenue outlook for the year ahead.

The company reported fourth quarter revenue of $197 million, up 31% from a year ago, with earnings of 9 cents a share. Non-GAAP earnings in the fourth quarter were 15 cents a share.

Wall Street was expecting Dynatrace to report fourth quarter sales of $191.8 million with non-GAAP earnings of 14 cents a share.

For fiscal 2021, Dynatrace reported revenue of $704 million, up 29% from a year ago. Earnings were 26 cents a share (63 cents a share non-GAAP).

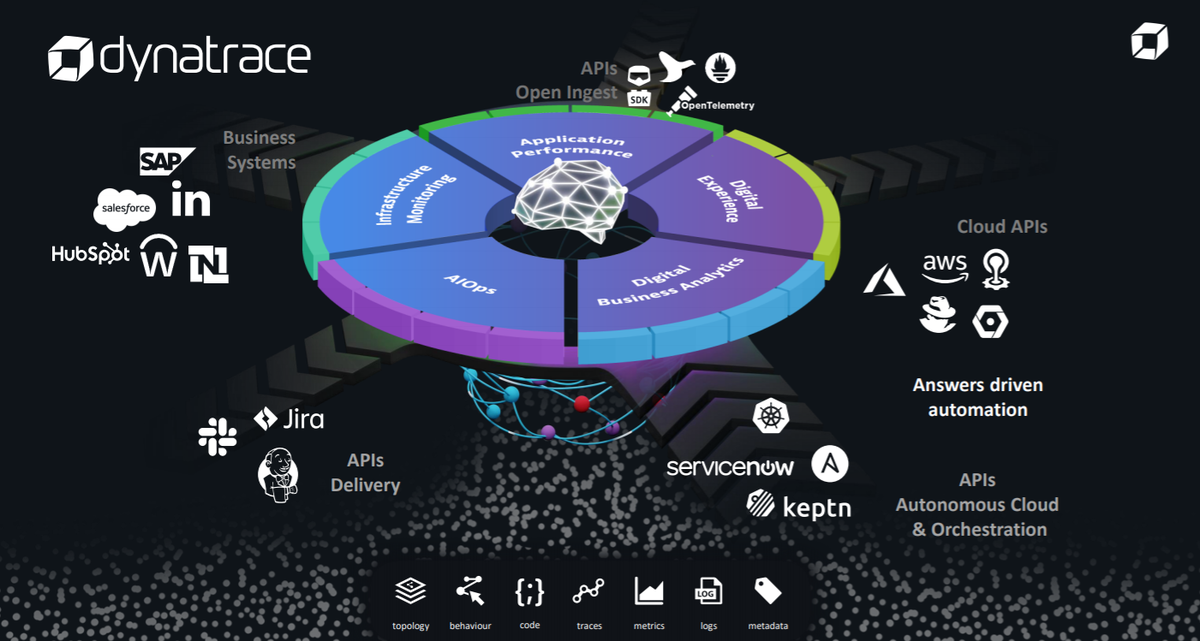

The observability space has heated up in recent days as ServiceNow entered the market via the purchase of Lightstep. The market now includes Dynatrace, BMC, Datadog, Sumo Logic, Splunk's SignalFx, New Relic and a host of others. Dynatrace CEO John Van Siclen said digital transformation and cloud-first architectures are accelerating.

What is low-code and no-code? A guide to development platforms

"We're starting to see signs of stabilization in the vertical markets most heavily impacted by the pandemic. These previously challenged verticals are once again investing in their digital transformation journeys," he said on an earnings conference call.

Van Siclen addd that Dynatrace has bnefited from go-to-market partnerships with the big three cloud providers Microsoft Azure, AWS and Google Cloud.

During the quarter, Dynatrace launched additional AI support for Kubernetes, released a new module for its Cloud Automation Module and landed AWS Machine Learning Competency status.

As for the outlook, Dynatrace said it sees first quarter revenue between $202 million to $204 million with non-GAAP earnings between 14 cents a share and 15 cents a share. For fiscal 2022, Dynatrace projected revenue between $885 million and $900 million with non-GAAP earnings between 59 cents a share and 62 cents a share.

That revenue guidance for first quarter and fiscal 2022 was ahead of expectations.

Recent observability headlines include:

- New Relic open sources Pixie, its Kubernetes-native in-cluster observability platform

- Datadog Q4 results and outlook top expectations, acquires Timber Tech and Sqreen for observability, security

- IBM buys Turbonomic to build out AIOps tools

- Cisco acquires software startup Dashbase to bolster observability in AppDynamics

- Splunk to acquire cloud network observability provider Flowmill

- New Relic snaps up Kubernetes observability solutions provider Pixie Labs

- Observability, Stage 3: Distributed tracing as a service by logz.io

- Splunk debuts Observability Suite, which integrates SignalFx, Omnition technology into one platform

User Center

User Center My Training Class

My Training Class Feedback

Feedback

Comments

Something to say?

Log in or Sign up for free