Salesforce handily beat its first quarter revenue and earnings targets and said it expects to reach $50 billion in revenue in fiscal 2026.

The company reported first quarter earnings of 50 cents a share on revenue of $5.96 billion. Non-GAAP earnings in the quarter were $1.21 a share.

Wall Street was looking for first quarter revenue of $5.89 billion with non-GAAP earnings of 88 cents a share.

Amy Weaver, Salesforce CFO, said the company saw "record levels of new business and strength across all products, regions, and customer sizes."

CEO Marc Benioff said Salesforce's Customer 360 platform is resonating with companies with accelerating growth as economies reopen.

On a conference call with analysts, Benioff said that Dreamforce will be held Sept. 21-23 as a hybrid physical and virtual event.

Benioff also credited Weaver with revamping Salesforce's operating model and improving margins. Benioff also noted that Salesforce is landing more large deals that involve more of its clouds as well as Tableau and MuleSoft. Benioff said:

We hit an all-time high in 7-figure plus transactions. It really shows the whole world is going digital, and customers are connecting with their customers in a new way, and everyone needs CRM to do it. And they need analytics, and they need integration, and we are the leaders in that area.

On average, these 7-figure transactions, they included 4 or more of our clouds. And our successful integrations of and Tableau and MuleSoft continue to drive these incredible results for our customers and gives us so much confidence in this pending Slack acquisition. Tableau was part of 8 of our top 10 deals. That really is evidence and the integration we've had with Customer 360 of its success. And MuleSoft was included in 5 of these top 10 deals.

Weaver also noted how Salesforce is balancing growth, investment and profit. "I want to be clear that growth remains our #1 priority. Investing into growth, especially in this demand environment, is simply the best thing we can do for the company. That said, I am a big believer that a focus on discipline that makes for a stronger and more durable company. So over the long term, I believe we need to be able to deliver both," she said.

Benioff cited Honeywell, 3M and Dell Technologies as big digital transformation customers.

Headlines in the quarter include:

- MuleSoft adds DataGraph to Anypoint Platform to streamline API requests

- Salesforce integrates personalized learning into daily workflows

- Salesforce updates Service Cloud to meet post-pandemic consumer demands

- Salesforce updates Vaccine Cloud with asynchronous registration and scheduling

- Salesforce updates Sales Cloud for more digital, data-driven sales

- Salesforce rolls out Rebate Management tool for B2B sales

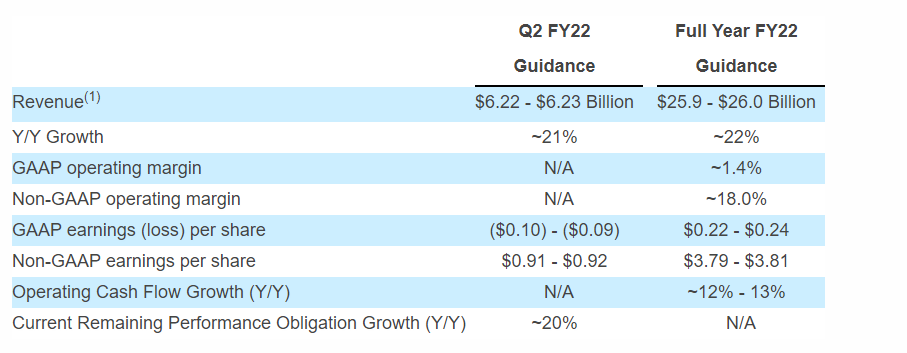

For the fiscal second quarter, Salesforce projected revenue of $6.22 billion to $6.23 billion, up about 21%. For the second quarter, Wall Street was modeling non-GAAP earnings of 86 cents a share on revenue of $6.15 billion.

Salesforce also raised its fiscal 2022 outlook and projected revenue of $25.9 billion to $26 billion with non-GAAP earnings of $3.79 a share to $3.81 a share. The outlook includes contribution of the Slack acquisition, which is now expected to close near the end of the second quarter.

Wall Street was modeling fiscal 2022 earnings of $3.43 a share on revenue of $25.76 billion.

Related:

User Center

User Center My Training Class

My Training Class Feedback

Feedback

Comments

Something to say?

Log in or Sign up for free