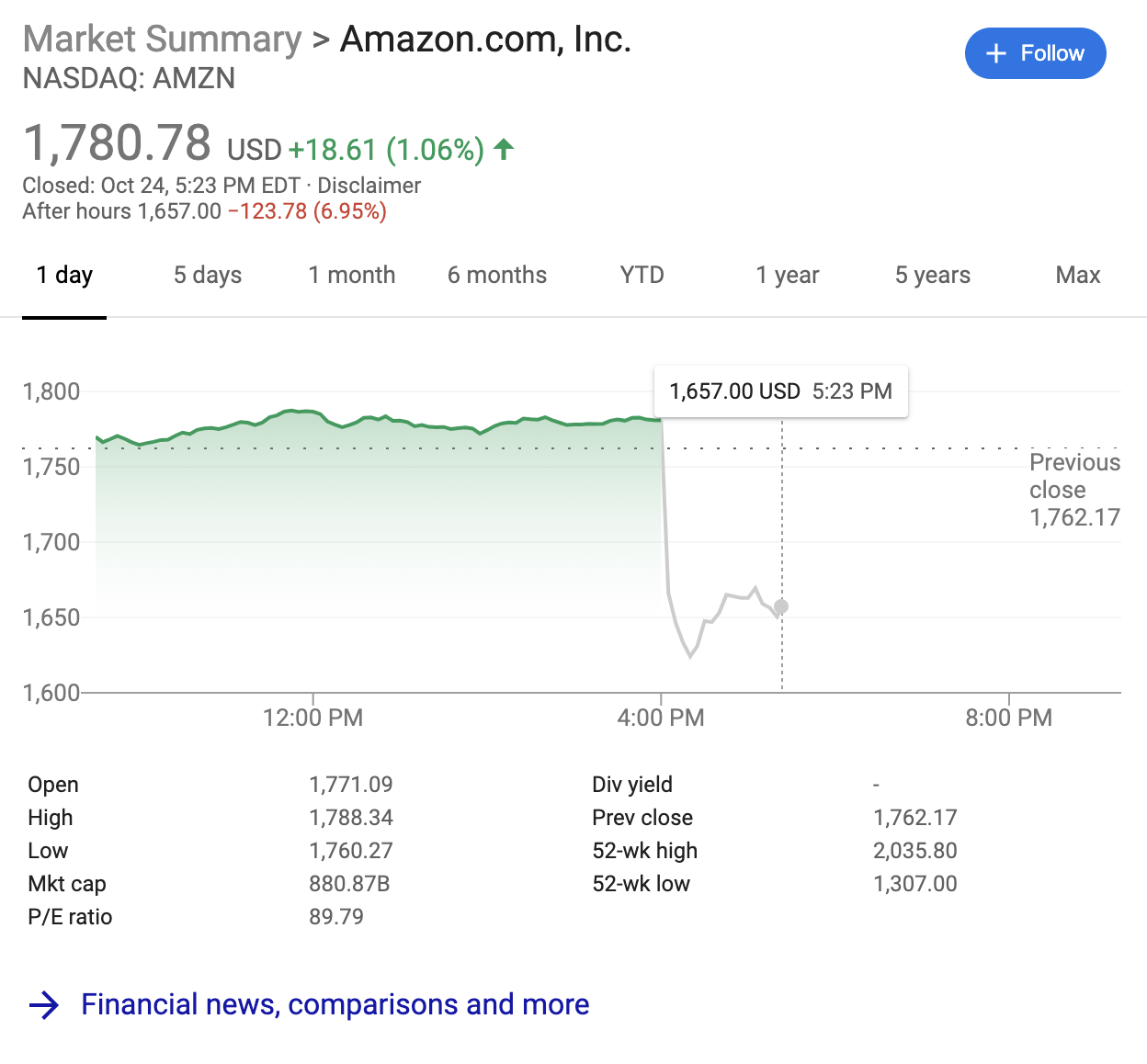

Amazon shares fell by nearly 7%, or $118.38, in after-hours trading on Thursday after the company reported its first earnings miss in two years.

Financial analysts had predicted that the launch of one-day shipping would eat into Amazon’s earnings, but even with the forewarning investors pummeled the stock after the market closed. It didn’t help that the company predicted revenues for the fourth quarter — including the all-important holiday season — also look soft.

The good news for Amazon amidst all the bad news was that revenue was actually up at the company. For the quarter Amazon raked in $70 billion, beating analysts’ expectations of $68.8 billion.

However, the company reported a profit of $2.1 billion, or $4.23 a share versus the $4.62 that analysts had projected. And even though sales were up this year, earnings per share were down from $5.75 in the year-ago period. As MarketWatch noted, it’s the first time earnings at the company have shrunk year-over-year since 2017.

Another potential warning sign for investors was the revenue from the company’s web services business, which came in at $9 billion. Analysts had predicted roughly $9.2 billion from the business line. If competition starts eating into the services business (which still grew at a healthy 35% over the year-ago period), that could spell problems for the company’s stock — which has used AWS revenues to buoy spending elsewhere.

The company has been spending heavily all year to offer new services. The expansion of its free one-day delivery program has cost Amazon more than $800 million in the second quarter.

Amazon founder and chief executive Jeff Bezos defended the move to one-day shipping in a statement.

“Customers love the transition of Prime from two days to one day — they’ve already ordered billions of items with free one-day delivery this year. It’s a big investment, and it’s the right long-term decision for customers,” Bezos said. “And although it’s counterintuitive, the fastest delivery speeds generate the least carbon emissions because these products ship from fulfillment centers very close to the customer — it simply becomes impractical to use air or long ground routes.”

Looking ahead to the holiday season Amazon predicted net sales of between $80 billion and $86.5 billion, with operating income between $1.2 billion and $2.9 billion, versus $3.8 billion from a year-ago period. Analysts were expecting to see revenue numbers more in the $87 billion range.

User Center

User Center My Training Class

My Training Class Feedback

Feedback

Comments

Something to say?

Log in or Sign up for free